Vaishali Jain | 6th March 2023

Impact investing is rapidly revolutionising the way businesses approach investments and funding. There is an increasing prioritisation on investment in projects that not only have a positive impact on society and the environment but also generate sustainable financial returns. The Europe-India Business Corridor has witnessed increased traction due to win-all dynamics of such emerging models.

Impact investing not only creates positive societal changes and development, solving an urgent need for the community, but it also leads to higher long-term and sustainable ROI. It should thus be seen in complementarity to investor wealth building. For instance, a study by Morgan Stanley, which analysed 11,000 mutual funds, revealed that sustainable funds reduced, on average, downside risk by 20%, leading to higher stability in the medium-long term.

Growth of Impact Investing in India

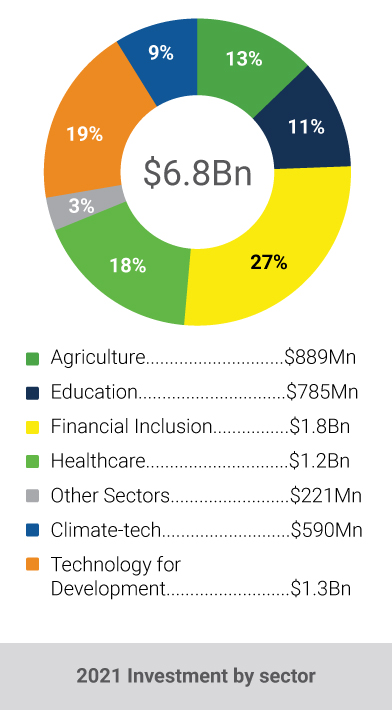

According to the latest report by the Indian Impact Investors Council (IIIC), 294 impact enterprises in India attracted $6.8 billion in equity investments over 3450 partnerships in 2021. While the number of deals rose marginally by 5%, there was a significant jump in total investment volume by 135% as compared to 2020. The median investment for impact investments in India has been increasing steadily and was around $2 million in 2021.

Impact investors in India continue to have a blended return expectation (financial and impact) with about 80% of investors having a blended return expectation while only 20% are focused solely on financial returns. The majority of impact investors in India are domestic investors (about 61%), followed by international investors (about 39%). Development finance institutions (DFIs) and Foundations are the largest categories of international investors

Some of the sectors that attracted the most investments are: Financial Inclusion, Technology for Development, and Healthcare continued to be the sectors that attracted the most impact investments in India. In terms of geographical distribution, while impact investments are being made across the country, around 58% of the investments were made in the top 5 states - Maharashtra, Karnataka, Tamil Nadu, Delhi, and Gujarat.

In an estimate by McKinsey, impact investments in India have the potential to grow 20-24% a over the next couple of years, reaching USD 6 to 8 billion in deployment due to increased interest from domestic and foreign investors, which is anticipated to fuel the industry's growth in the upcoming years.

The core drivers behind this recent growth, as well as optimistic future prospects in impact investing being increasing awareness of its benefits, global commitment to reduction in carbon footprint leading to a favourable regulatory environment, economic growth led increase in demand, and visible stability in geo-political and financial markets.

EU and India: At the fore of Impact Funding

In the EU-India business ecosystem, European businesses are increasingly looking a India for investments, with a focus on sectors such as renewable energy, automotive, and technology. An enhanced EU-India partnership on sustainable modernisation, with a focus on collaboration on climate change, the environment, green energy, and urbanization, was identified by the European Commission as a crucial component of the EU's India strategy in its note to the European Parliament and the European Council in 2018. This partnership was purposed to "assist the EU and India to meet internal objectives as well as international commitments," according to the European Commission.

For example, since 2016, the EU and India have jointly pursued the Clean Energy and Climate Partnership (CECP), which focuses on the fields of energy efficiency, renewable energy, smart grids, storage, sustainable finance, and climate mitigation and adaptation in tune with the Paris Agreement.

According to the European Investment Bank (EIB), the EU had committed to investing over €3 billion in India between 2017 and 2020. This investment was to be aimed at supporting sustainable development and addressing common challenges in areas such as energy, water, and urban development. The strong trade relations between India and the EU, as well as the Indian government's efforts to promote investment, make India an attractive destination for European investors.

Along similar veins, The India-EU Strategic Partnership: Roadmap to 2025 was jointly endorsed by both regions on July 15, 2020, following the 15th India-EU Summit. In order to increase access to sustainable energy, they recommended raising finance and enhancing investment sentiment. By accelerating ‘deployment of renewable energy, promoting energy efficiency, working together on smart grid and storage technology, and modernizing the electricity market,’ the 16th EU-India Summit on May 8, 2021, decided to further the two countries' cooperation under the 2016 Clean Energy and Climate Partnership.

By facilitating private sector investments for the transition to a climate-neutral, resource-efficient, and inclusive economy, sustainable finance in EU supports goals of the European Green Deal. The promptness and far-sightedness of the governments involved in recognising and executing key policy measures directed towards achieving aligned goals has proven beneficial in more ways than one.

A global platform on sustainable finance established in 2019 by the EU in collaboration with other significant developing economies, including India, holds the potential to aid increasing private capital investment in environmentally sustainable projects.

Government Initiatives in India to Boost Impact Investments

To increase accountability to stakeholders and guarantee that investments are environmentally sustainable, India, a platform member, introduced Business Responsibility Reporting (BRR). According to the National Voluntary Guidelines, the Security and Exchange Board of India (SEBI) required the top 100 listed companies by market capitalisation to submit BRRs in 2012, later increased to 500 in 2015.

The Business Responsibility and Sustainability Report (BRSR) furthers the objectives of BRR. It will be required starting in the fiscal year 2022 for the top 1000 listed companies. ESG integration and reporting will be improved with the release of the National Guidelines on Responsible Business Conduct by the Ministry of Foreign Affairs. This will then create opportunities for cooperation with the EU, which is preparing to introduce a new taxonomy for green finance on Europe's financial markets, and raise the profile of green finance in India's financial sector.

In the medium-long term, India and the EU may consider establishing joint sustainable finance standards to hasten the mobilisation of private capital for both regions' respective efforts at climate change adaptation and mitigation. India has also witnessed an infusion of capital to support sustainability-related projects. Early in 2020, an agreement was made for the European Investment Bank (EIB) to give India 800 million euros to support clean energy initiatives.

Moreover, in the Union Budget of 2019–20, the Indian government announced the establishment of a social stock exchange (SSE) to help social enterprises and voluntary organizations raise capital. This was intended to be a platform for raising capital from both mainstream and impact investors and was expected to increase the availability of capital for impact ventures in India. In terms of tax incentives for impact investors and investments in social startups, the 2019–20 Union Budget announced tax incentives for investors in social startups, while the 2021-22 budget announced tax incentives for impact investors too. Investments made by individuals and Hindu Undivided Families (HUFs) in social startups registered with the Ministry of Corporate Affairs were eligible for a tax deduction of 100% of the investment amount. In the same year, the government also announced the establishment of a dedicated fund for startups in order to provide equity funding to startups in sectors such as healthcare, education, and infrastructure, with an initial corpus of Rs. 1,000 crore ($135 million) for the fund.

Given the outlook and the dynamically changing arena of investing, impact investing in India and EU is growing at an unprecedented pace, with government support and a growing number of companies and investors are recognising its potential. This is leading to several project opportunities having innovative structures to deliver both financial returns and positive social returns. Businesses, investors, including traditional institutional investors, private equity firms, and individual investors should position themselves to reap the benefits to be brought forth by all stakeholders in this green-horn avenue.

Impact Investing, Sustainability, Investment