Anuj Trivedi & Vijay Sureka | 4th Sep 2020

MSMEs have, for many years, been the backbone of the Indian economy. With more than 60 million MSMEs operating across India, MSMEs contribute approximately 30% to India’s overall GDP and 24.63% to India’s GDP from service activities. MSMEs also contribute approximately 45% of the overall exports from India and provide employment to approximately 120 million people, which is second only to agriculture sector. The Government of India (“GoI”) has set itself a target of ensuring that MSMEs contribute more than 50% to India’s GDP and offer at least 150 million jobs over the next 5 years.

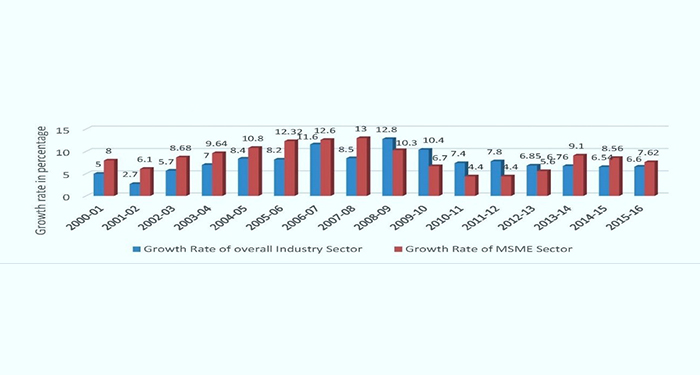

The MSME sector has consistently registered a higher growth rate than the overall growth of industrial sector for many years, as is highlighted by the graph below.

Given the significance of the MSME sector in the Indian economy, the GoI announced a special economic package (“Economic Package”) to support the MSME sector during the ongoing COVID-19 pandemic. Some of the key reforms that have been announced by the GoI which are expected to go a long way in benefiting the MSME sector and providing it impetus to withstand the headwind being faced during the ongoing pandemic are set out below:

In order to allow more companies to avail of the benefit of being an MSME, the definition of MSMEs has been revised by raising the investment limit, introducing an additional criterion of turnover and removing the distinction between manufacturing and service sector. The revised thresholds now allow companies having an investment of up to INR 50 Crore (USD 6.6 million) and turnover of upto INR 250 crore (USD 33 million) to fall within the definition of MSME.

To handle the problem of delayed payments and to ensure speedy disposal of cases related to delayed payments, the GoI has launched the MSME Samadhaan portal, which is a dedicated delayed payment monitoring portal that allows MSMEs to file an online complaint of delayed payment. In addition, the MSME Ministry has also recently interlinked the Samadhaan portal with National E-Governance Service Ltd.’s Information Utility (IU), which has a system of triggering a ‘Default Alert’ in case of non-payment of dues, that is broadcasted to all lenders of the concerned defaulter, as a means to create pressure on them for clearance of the outstanding payments.

Due to lack of scale and in-house capabilities, MSMEs face the twin challenge of limited access to quality raw materials and market for finished products. Inaccessibility to remunerative markets obviously affects their growth and sustainability. To overcome this issue, the GoI has launched the Government e-Marketplace (GeM) portal, which is an online marketplace for procurement by GoI departments. E-market linkage is another measure announced as a part of the Economic Package, which will be provided for all MSMEs as a replacement for trade fairs and exhibitions.

The GoI has disallowed global tenders for procurement of goods and services by the GoI worth less than INR 200 crore (USD 26.5 million). While this initiative is not meant exclusively for MSMEs, this move, coupled with the policy that requires every GoI ministry, department and public sector undertaking of the GoI to procure at least 25% of its total annual purchases from MSMEs, will certainly provide an impetus to the MSME sector. Total procurement from MSMEs under this requirement for the financial year 2019-2020 exceeded INR 37,000 crore (USD 5 billion).

Other measures announced by the GoI to provide credit and risk capital to the MSME sector include:

To provide additional funding for MSMEs to help them restart business, the Economic Package has made a provision for INR 3 lakh crore (USD 40 billion) worth of collateral-free automatic loans to certain businesses. The GoI is providing 100% credit guarantee cover to the lending banks and NBFCs on principal and interest in respect of all such loans.

To provide equity support for MSMEs which have been classified as non-performing assets or are stressed, GoI is facilitating facilitate provision of INR 20,000 crore (USD 2.7 billion) as subordinate debt to promoters of such MSMEs. Banks are expected to provide the subordinate-debt to promoters of such MSMEs equal to 15% of their existing stake in the unit subject to a prescribed ceiling.

To help MSMEs expand, a Fund of Funds (“FoF”) with Corpus of INR 10,000 crore (USD 1.3 billion) is proposed to be established. The FoF will be operated through a Mother Fund and a few Daughter Funds (which would typically be SEBI registered AIFs). Expected leverage of 1:4 at the level of Daughter Funds will lead to mobilization of equity of INR 50,000 crore (USD 6.7 billion). MSMEs will also be encouraged to get listed on the main board of the stock exchanges.

The minimum threshold to initiate insolvency proceedings against an Indian company has been raised from the existing INR 1 lakh (USD 1340) to INR 1 crore (USD 134,000). The GoI has also suspended fresh initiation of insolvency proceedings for a period of 6 (six) months. Further, COVID-19 related debt has been excluded from the definition of “default” for insolvency proceedings. Further, it is proposed that the promoters and founders of a stressed MSME will be permitted to present a resolution plan, should an insolvency proceeding be initiated against such MSME.

In addition to the aforesaid reforms, the GoI has also taken steps to remove the infrastructure bottlenecks which is often a major issue faced by the industry. The task force that was set up by the Department of Industrial Policy and Promotion to draw up the National Infrastructure Pipeline, has projected infrastructure investment of up to INR 111 lakh crore (USD 1.472 trillion approx.) over the next 5 years. The proposal inter alia includes development of 9,000 km of economic corridors by 2025. These measures will ensure that a world class infrastructure is available in the country to support the industry.

In February 2020, the Ministry of Finance (GoI) proposed setting up of an Investment Clearance Cell with the intention of providing “end to end” facilitation and support to create more opportunities and remove roadblocks in obtaining the different approvals required for various purposes. The idea behind the proposed investment clearance cell is to give investors free investment advisory, land banks and facilitate clearances even at state level. The civil aviation ministry has already set up its single clearance window pursuant to the aforesaid announcement. The other ministries are expected to follow suit soon.

One of the important reasons for slow intake in the utilization of existing schemes in the MSME sector is the lack of awareness about schemes and their likely benefits. The current knowledge dissemination system is limited in its outreach and we feel that with better communication strategy, the MSME sector will be able to contribute even more to the Indian economy. We also believe that involvement of large domestic and international enterprises in the development of MSME clusters will help facilitate MSMEs in building long-term relationships with large enterprises which will further help boost the business ecosystem.

MSME sector has traditionally faced many daunting challenges and the road ahead also will not be easy. Whilst the GoI has put in a lot of effort and has proposed a plethora of policy initiatives, the key challenge which still remains, in our view, is the effective implementation of these reforms and policy initiatives going forward. The real impact of these policy initiatives and reforms can be attained only if the benefits reach the intended recipients in the form and manner contemplated.

The Bottom Line: The policy initiatives announced by the GoI are well calibrated and there is a visible effort on the part of the GoI to further ease doing of business in India. With the tailwind of these Government initiatives, favourable demographics and growth in the working-age population leading to an increase in employment optimism, we believe there is a huge potential for the MSMEs to enter the international markets which will also create an upsurge in the employment opportunities in India. There is also a huge potential in the MSME sector to go international and market its ‘Made in India’ brand in order to explore more opportunities and enhance global possibilities.

business, technology, tech, greentech, green